Embark on a journey to discover effective ways to reduce auto insurance premiums. From practical tips to insightful strategies, this guide will help you navigate the complex world of insurance costs with ease.

Unravel the mysteries behind auto insurance premiums and uncover the secrets to saving money while maintaining optimal coverage.

Introduction to Auto Insurance Premiums

Auto insurance premiums refer to the amount of money that an individual pays to an insurance company in exchange for coverage in case of any damage, loss, or injury related to their vehicle. These premiums are typically paid on a monthly or annual basis.

Reducing auto insurance premiums is important as it can help individuals save money in the long run. By taking steps to lower their premiums, policyholders can ensure that they are getting the best value for their coverage while also making their insurance more affordable.

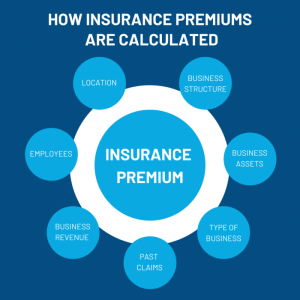

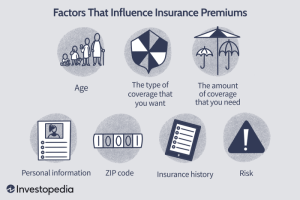

Factors Influencing Auto Insurance Premiums

- Driving Record: A clean driving record with no accidents or traffic violations usually leads to lower premiums as it indicates a lower risk of accidents.

- Vehicle Type: The make and model of the vehicle can impact premiums, with safer and more affordable cars typically resulting in lower insurance costs.

- Age and Gender: Younger drivers and male drivers often face higher premiums due to statistical data showing a higher likelihood of accidents in these groups.

- Location: Where the vehicle is parked or driven can also affect premiums, with higher crime or accident rates in an area leading to higher costs.

- Coverage Options: The type and amount of coverage selected by the policyholder can influence premiums, with more comprehensive coverage usually resulting in higher costs.

Ways to Reduce Auto Insurance Premiums

Reducing auto insurance premiums is important for saving money while still maintaining adequate coverage. Here are some effective ways to lower your premiums:

Increase Deductibles

Increasing your deductibles can significantly reduce your auto insurance premiums. By opting for a higher deductible, you are essentially taking on more financial responsibility in the event of a claim. This can lead to lower premiums since the insurance company’s risk is reduced.

Maintain a Good Credit Score

Your credit score can have a significant impact on your auto insurance premiums. Insurance companies often use credit information to determine the likelihood of a policyholder filing a claim. By maintaining a good credit score, you can demonstrate financial responsibility, which can lead to lower premiums.

Comparison of Income Funds and Index Funds

Income funds and index funds are two types of investments that cater to different investor preferences and goals. Income funds primarily focus on generating regular income through dividends and interest payments, while index funds aim to track the performance of a specific market index by holding a diversified portfolio of securities.When comparing the performance of income funds versus index funds, it is essential to consider various factors.

Income funds typically offer higher dividend yields and interest payments, making them attractive for investors seeking regular income streams. However, they may have lower capital appreciation potential compared to index funds, as they prioritize income generation over growth.On the other hand, index funds provide broad market exposure and tend to have lower management fees due to their passive investment strategy.

They aim to replicate the performance of a market index, such as the S&P 500, by holding the same securities in the same proportions as the index. This approach can lead to lower volatility and higher long-term returns compared to actively managed income funds.When it comes to risks and rewards, income funds offer stability and predictable income streams, making them suitable for conservative investors or those in retirement.

However, they may be more susceptible to interest rate changes and credit risk, especially in bond-focused income funds. Index funds, on the other hand, provide diversification and low cost exposure to the overall market, reducing individual stock risk but still subject to market fluctuations.In conclusion, choosing between income funds and index funds depends on individual investor goals, risk tolerance, and time horizon.

Income funds are ideal for investors seeking regular income, while index funds are suitable for those looking for broad market exposure and long-term growth potential.

Understanding Inflation Hedge

An inflation hedge is an investment that helps protect the value of your portfolio from the effects of inflation. Inflation erodes the purchasing power of your money over time, so it is essential to have investments that can keep pace with or outpace inflation to maintain your wealth.

Types of Investments as Inflation Hedge

- Real Estate: Investing in real estate can be a good hedge against inflation as property values tend to increase with inflation.

- Commodities: Commodities like gold, silver, and oil are often considered inflation hedges because their prices typically rise when inflation increases.

- TIPS (Treasury Inflation-Protected Securities): These bonds are specifically designed to protect against inflation by adjusting their principal value based on changes in the consumer price index.

Protecting Portfolios Against Inflation

- Diversification: Spread your investments across different asset classes to reduce the risk of inflation affecting your entire portfolio.

- Stocks: Investing in stocks of companies that have pricing power and can increase their prices in line with inflation can help protect your portfolio.

- Dividend-Paying Stocks: Companies that pay dividends can provide a source of income that may keep pace with or exceed inflation rates.

Impact of Inflation on Insurance Premiums

Inflation can have a significant impact on insurance premiums, as the cost of goods and services rises over time. Insurance companies may adjust their premiums to account for the increased cost of claims processing, repairs, and medical expenses. This can lead to higher insurance costs for policyholders.

Strategies for Mitigating the Impact of Inflation on Insurance Costs

It is essential to take proactive steps to mitigate the impact of inflation on your insurance costs. Here are some strategies to consider:

- Regularly review your insurance coverage: Periodically reassess your coverage needs to ensure you are adequately protected without overpaying for unnecessary coverage.

- Shop around for competitive rates: Compare quotes from multiple insurance providers to find the best rates and discounts available.

- Consider bundling policies: Bundling your auto, home, and other insurance policies with the same provider can often lead to cost savings.

- Ask about discounts: Inquire about discounts for safe driving records, anti-theft devices, or completing a defensive driving course.

Tips on Adjusting Insurance Coverage to Account for Inflation

Adjusting your insurance coverage to account for inflation can help ensure you have adequate protection without overpaying. Consider the following tips:

- Update your coverage limits: Regularly review and adjust your coverage limits to keep pace with rising costs of repairs, medical bills, and other expenses.

- Consider increasing deductibles: Increasing your deductibles can lower your premiums, but be sure you can afford the out-of-pocket expenses in the event of a claim.

- Review your policy annually: Take the time to review your policy annually with your insurance agent to make any necessary adjustments based on your changing needs and inflation rates.

In conclusion, mastering the art of reducing auto insurance premiums is not only financially rewarding but also empowers you to make informed decisions about your coverage. Take control of your insurance costs and drive confidently towards a more secure financial future.

FAQ Corner

How can I lower my auto insurance premiums effectively?

Consider bundling your policies, maintaining a good credit score, and opting for a higher deductible to potentially lower your auto insurance premiums.

Does maintaining a good credit score really help in reducing auto insurance premiums?

Yes, insurance companies often use credit scores to determine premiums. A good credit score can demonstrate financial responsibility and lead to lower insurance costs.

Is it advisable to increase deductibles to reduce auto insurance premiums?

Increasing deductibles can lower your premiums, but make sure you can afford the higher out-of-pocket costs in case of an accident.

How does inflation impact auto insurance premiums?

Inflation can lead to increased costs for insurance companies, which may be passed on to policyholders through higher premiums. Adjusting coverage to account for inflation can help mitigate these effects.