How to Lower Insurance Premiums sets the stage for this informative guide, offering readers practical advice on reducing insurance costs with clarity and precision.

Exploring the key factors affecting insurance premiums and effective strategies to lower them, this discussion aims to empower individuals in making informed decisions regarding their insurance policies.

Introduction to Insurance Premiums

Insurance premiums are the amount of money an individual or business pays to an insurance company in exchange for coverage against specified risks. These premiums can vary based on factors such as the type of insurance, coverage limits, deductible amounts, and the insured party’s risk profile.Insurance premiums can be costly due to the potential risks involved in providing coverage. Insurance companies assess the likelihood of a claim being made and adjust premiums accordingly to ensure they can cover potential payouts while also making a profit.

Types of Insurance Premiums

- Auto Insurance Premiums: These premiums cover damages and liabilities related to vehicles, including accidents, theft, and vandalism.

- Homeowners Insurance Premiums: These premiums protect against damages to a home and personal belongings due to events like fire, theft, or natural disasters.

- Health Insurance Premiums: These premiums provide coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

- Life Insurance Premiums: These premiums offer financial protection to beneficiaries in the event of the policyholder’s death.

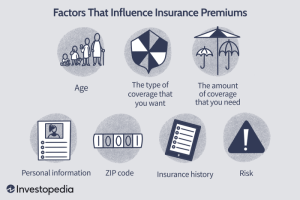

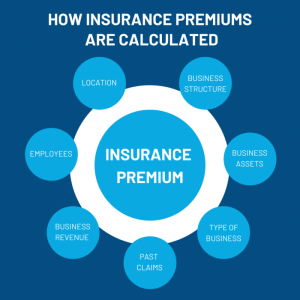

Factors Affecting Insurance Premiums

Insurance premiums are influenced by various factors that help insurers assess risk and determine the cost of coverage for individuals. Understanding these factors can help you make informed decisions to lower your insurance costs.

Age and Location

Age and location are two key factors that significantly impact insurance premiums. Younger drivers are often charged higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. Similarly, individuals living in areas prone to natural disasters or with high crime rates may face higher premiums to account for the increased risk of filing claims.

Credit Score

Your credit score also plays a role in determining insurance premiums. Insurers use credit-based insurance scores to assess the likelihood of a policyholder filing a claim. Individuals with higher credit scores are typically viewed as more financially responsible and may qualify for lower premiums, while those with lower scores may face higher rates.

Strategies to Lower Insurance Premiums

When it comes to insurance premiums, there are several strategies you can implement to help lower your costs. From bundling policies to maintaining a good driving record, these tips can make a significant impact on how much you pay for your insurance coverage.

Bundling Insurance Policies

One effective way to lower your insurance premiums is by bundling multiple policies with the same insurance provider. This means combining your home, auto, and possibly even life insurance policies under one insurer. By doing so, insurance companies often offer discounts as an incentive to keep all your business with them.

Increasing Deductibles

Another strategy to consider is increasing your deductibles. The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can lower your premiums. However, it’s essential to ensure that you can afford the increased out-of-pocket costs in case of a claim.

Maintaining a Good Driving Record

Your driving history plays a significant role in determining your insurance premiums. By maintaining a good driving record with no accidents or traffic violations, you can demonstrate to insurance companies that you are a low-risk driver. As a result, you may qualify for lower premiums as you pose less of a financial risk to the insurer.

Comparison: Income Funds vs. Index Funds

Income funds and index funds are two popular investment options that cater to different investor preferences and goals. Income funds primarily focus on generating regular income through dividends, interest payments, or other sources, making them suitable for investors seeking steady cash flow. On the other hand, index funds aim to replicate the performance of a specific market index by holding a diversified portfolio of securities, offering investors broad market exposure with low management fees.

Differentiating Income Funds and Index Funds

Income Funds:

- Income funds invest in securities that pay regular income, such as bonds, dividend-paying stocks, or real estate investment trusts (REITs).

- These funds are ideal for investors looking for steady income streams, such as retirees or individuals seeking passive income.

- Risks associated with income funds include interest rate risk, credit risk, and default risk, which can impact the fund’s performance.

- Benefits of income funds include regular income distributions, potential capital appreciation, and diversification within the portfolio.

Index Funds:

- Index funds track a specific market index, such as the S&P 500, by holding a representative sample of the index’s constituent securities.

- These funds offer broad market exposure, diversification, and low management fees compared to actively managed funds.

- Investors in index funds benefit from the market’s overall performance, rather than relying on individual stock or bond selection.

- Risks associated with index funds include market risk, tracking error, and the inability to outperform the benchmark index.

Understanding Inflation Hedge

Inflation hedge refers to investments or assets that have the potential to maintain or increase their value in times of inflation. These hedges help investors protect their portfolios from the eroding effects of inflation by providing a buffer against rising prices.

Types of Inflation Hedges

- Real Estate: Real estate investments are considered inflation hedges as property values tend to increase during inflationary periods. Rental income from real estate can also adjust with inflation, providing a steady cash flow.

- Commodities: Commodities like gold, silver, oil, and agricultural products are often used as inflation hedges. These tangible assets tend to retain their value or increase in price as inflation rises.

- TIPS (Treasury Inflation-Protected Securities): TIPS are government bonds that adjust their principal value with inflation. They offer investors protection against rising prices by ensuring a real rate of return.

Using Inflation Hedges in Portfolios

Investors can incorporate inflation hedges into their portfolios to mitigate the impact of inflation on their investments. By diversifying with assets that have inflation-hedging qualities, investors can safeguard their wealth and maintain purchasing power.

Impact of Inflation on Insurance Premiums

Inflation can have a significant impact on insurance premiums, as it can erode the purchasing power of the premium amount over time. Insurance companies may need to increase premiums to keep up with rising costs due to inflation.

Strategies to Mitigate the Impact of Inflation on Insurance Costs

- Consider purchasing insurance policies with fixed premiums to lock in rates before they increase due to inflation.

- Review and update your insurance coverage regularly to ensure you have adequate protection against inflationary pressures.

- Explore bundling policies with the same insurance provider to potentially receive discounts and offset premium increases.

Examples of How Insurance Companies Adjust Premiums in Response to Inflation

- Insurance companies may conduct periodic reviews of their pricing models to account for inflation and adjust premiums accordingly.

- In some cases, insurance companies may offer inflation protection riders that allow policyholders to increase their coverage limits without undergoing medical underwriting.

- If inflation significantly impacts the cost of claims payouts, insurance companies may need to raise premiums across the board to maintain profitability.

In conclusion, mastering the art of lowering insurance premiums not only saves money but also ensures comprehensive coverage. Implementing the tips and strategies discussed can lead to significant savings in the long run, making insurance more affordable and accessible for everyone.

Top FAQs

How can bundling insurance policies help lower premiums?

By bundling multiple insurance policies with the same provider, you can often qualify for discounted rates, resulting in overall lower premiums.

Does maintaining a good driving record always lead to lower premiums?

Having a clean driving record typically leads to lower insurance premiums as it demonstrates responsible behavior on the road, reducing the risk for insurance companies.

What impact does increasing deductibles have on insurance premiums?

Increasing deductibles can lower insurance premiums as you agree to pay a higher amount out of pocket in the event of a claim, reducing the insurer’s risk.