Starting with Best Inflation Hedge for 2024, the discussion delves into various strategies and options to navigate the uncertain economic landscape, offering a comprehensive guide for investors seeking to safeguard their portfolios.

Exploring income funds, index funds, and insurance premiums, this guide aims to equip readers with the knowledge needed to make informed decisions in the face of rising inflation.

Income Funds

Income funds are investment vehicles that primarily aim to generate regular income for investors through various income-generating assets such as bonds, dividend-paying stocks, real estate investment trusts (REITs), and other fixed-income securities. These funds typically distribute dividends or interest income to investors on a regular basis, making them a popular choice for those seeking steady cash flow.

Types of Income Funds

- Bond Funds: These funds invest in a portfolio of bonds issued by governments, municipalities, corporations, and other entities, providing a steady stream of interest income to investors.

- Dividend Funds: Dividend funds focus on investing in stocks of companies that pay regular dividends to shareholders, offering a source of income through dividend payments.

- Real Estate Income Funds: These funds invest in income-generating properties such as commercial real estate, residential properties, and REITs, providing rental income and potential capital appreciation.

Potential Benefits and Risks

Investing in income funds can offer several benefits, including:

- Regular Income: Income funds provide a consistent source of income for investors, making them suitable for those looking to supplement their cash flow.

- Diversification: By investing in a variety of income-generating assets, income funds help spread risk and reduce the impact of market fluctuations on overall returns.

- Professional Management: Income funds are managed by experienced fund managers who make investment decisions on behalf of investors, saving them time and effort in managing their portfolios.

However, it’s essential to consider the risks associated with income funds, such as:

- Interest Rate Risk: Income funds, especially bond funds, are vulnerable to changes in interest rates, which can affect the value of their holdings and the level of income generated.

- Credit Risk: Investing in lower-quality bonds or dividend-paying stocks can expose income funds to credit risk, where the issuer may default on payments, leading to potential losses.

- Market Risk: Income funds are subject to market fluctuations, which can impact the value of their underlying assets and, consequently, the income distributed to investors.

Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a specific market index, such as the S&P 500. Unlike actively managed funds, index funds do not rely on a fund manager’s decisions to buy or sell individual securities. Instead, they passively follow the index they are designed to replicate.When comparing the performance of index funds to other types of investment vehicles, research has shown that index funds tend to outperform actively managed funds over the long term.

This is primarily due to lower fees and expenses associated with index funds, as well as the challenge of consistently beating the market through active management.

Selecting the Best Index Funds

When selecting the best index funds based on different investment goals, it is essential to consider factors such as expense ratios, tracking error, and the specific index being tracked. Here are some strategies to help investors choose the most suitable index funds:

- Consider the Expense Ratio: Lower expense ratios typically translate to higher returns for investors over time. Look for index funds with competitive expense ratios to maximize your investment gains.

- Evaluate Tracking Error: A low tracking error indicates that the index fund closely mirrors the performance of the underlying index. Choose index funds with minimal tracking error to ensure accurate tracking of the market.

- Review the Index Being Tracked: Different index funds track various market indices, such as large-cap stocks, small-cap stocks, or international markets. Select index funds that align with your investment objectives and risk tolerance.

- Diversify Your Portfolio: To reduce risk and enhance returns, consider investing in a mix of index funds that cover various asset classes and sectors. Diversification can help spread risk and optimize your investment portfolio.

Inflation Hedge

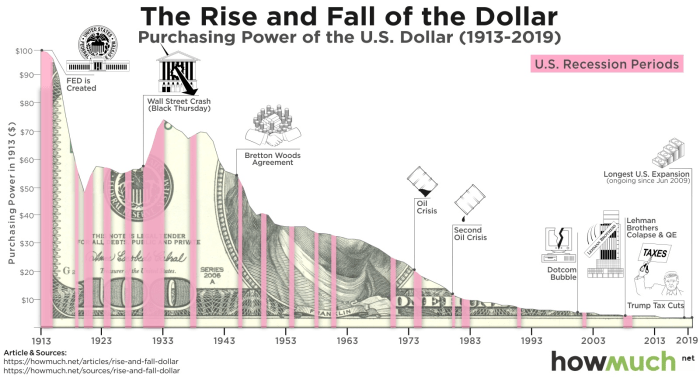

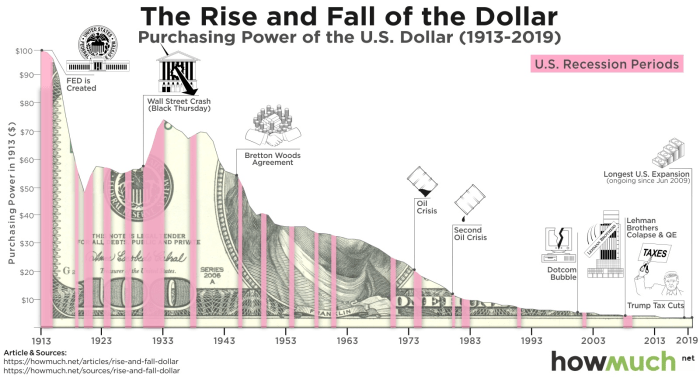

An inflation hedge is an investment that helps protect the value of assets against inflation. Inflation erodes the purchasing power of money over time, so investors look for ways to preserve their wealth by investing in assets that can outperform the inflation rate.

Various Investment Options as Inflation Hedges

There are several investment options that can serve as effective inflation hedges:

- Real Estate: Investing in real estate properties can provide a hedge against inflation as property values tend to increase with inflation.

- Commodities: Investing in commodities like gold, silver, and oil can be a good hedge against inflation as their prices tend to rise when inflation increases.

- TIPS (Treasury Inflation-Protected Securities): TIPS are government bonds that are indexed to inflation, providing investors with a guaranteed return above the inflation rate.

Factors to Consider when Choosing the Best Inflation Hedge for 2024

When choosing the best inflation hedge for 2024, investors should consider the following factors:

- Inflation Expectations: Consider the expected rate of inflation for 2024 and choose investments that can outperform this rate.

- Risk Tolerance: Consider your risk tolerance and choose investments that align with your risk profile.

- Time Horizon: Consider your investment time horizon and choose assets that can provide protection against inflation over the long term.

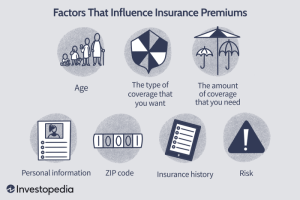

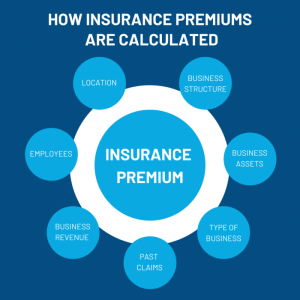

Insurance Premiums

Insurance premiums play a crucial role in managing risk by providing financial protection against unforeseen events. These regular payments to an insurance company ensure that policyholders are covered in case of accidents, illnesses, or other unexpected circumstances.

Types of Insurance Products

- Health Insurance: Covers medical expenses and provides financial protection against rising healthcare costs, which can be affected by inflation.

- Life Insurance: Offers financial support to beneficiaries in the event of the policyholder’s death, serving as a long-term financial planning tool.

- Property Insurance: Protects against damage to property caused by natural disasters, accidents, or theft, safeguarding investments from inflation-related risks.

Relationship with Financial Strategy

Insurance premiums are an integral part of an investor’s overall financial strategy as they help mitigate potential risks and uncertainties. By paying premiums, investors can transfer the financial burden of unexpected events to insurance companies, allowing them to focus on their investment goals without worrying about significant losses. It is essential to consider insurance products that align with one’s financial objectives and provide adequate coverage against inflation-related risks.

In conclusion, the quest for the best inflation hedge in 2024 requires a nuanced understanding of income funds, index funds, and insurance premiums, each playing a crucial role in mitigating financial risks and maximizing returns amidst changing market conditions.

Clarifying Questions

What are income funds?

Income funds are investment vehicles that aim to generate returns primarily through interest income and dividends from a variety of fixed-income securities.

How do index funds differ from actively managed funds?

Index funds passively track a specific market index, while actively managed funds involve a portfolio manager making investment decisions to outperform the market.

Why are insurance premiums important for managing risk?

Insurance premiums provide financial protection against unforeseen events and help individuals hedge against potential losses, thus playing a vital role in risk management.